-

DoubleDown Interactive(DDI) 3Q21 컨퍼런스콜주식/더블유게임즈 2021. 11. 16. 10:39

In Keuk Kim

Thank you, Jeff. Good afternoon, everyone. Thank you for joining us on our inaugural earnings call following our successful IPO in the third quarter. I'd also like to welcome our new shareholders. We are appreciative of our -- your support.

Before we discuss the results of our third quarter, I would like to first provide some background on DoubleDown for those of you who are newer to our company. We are a leading developer and publisher of digital games or mobile and web-based platforms. We were only pioneer in the social casino gaming segment as one of the initial publishers to launch a social casino game on Facebook in 2010.

Our goal is to become one of the world's leading global gaming companies by delivering differentiated content and playing experiences to our users. Our flagship game, DoubleDown Casino has been among the top 20 grossing mobile games annually on the Apple App Store since 2016 according to FME. We believe we have a deep understanding of our users, which allows us to refine our game development, content strategy and game operations.

We also have unique access to content through our relationship with IGT and our parent, DoubleU Games. We are able to leverage their slot games, many of which are exclusive to DoubleDown, while also developing our own content to provide a wide array of new and exciting casino-style games for players.

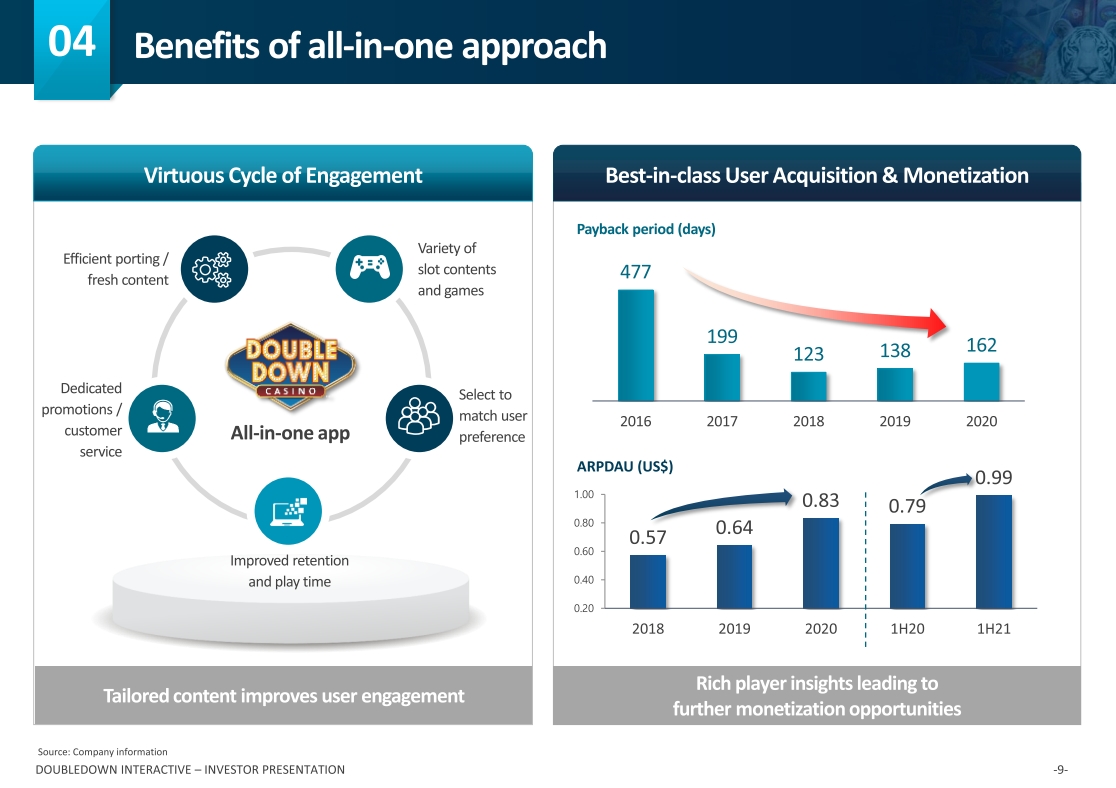

We have what we call an all-in-one approach with our DoubleDown Casino app. We believe that users prefer fewer apps on their smartphones not more so having an all-in-one solution creates better retention, lower user acquisition costs and higher lifetime value. DoubleDown Casino provides a diverse set of offerings to our players, ranging from authentic land-based slots to more casual slot games as well as other casino side games, such as single and table games.

A key part of our strategy is to augment our revenue streams by launching gaming apps outside of traditional social casino. Our first effort in this regard is Undead World: Hero Survival, which is an RPG that was launched globally at the end of September. While it is very early, we are pleased with initial player retention results and excellent rating scores in the App Store and Play Store.

For the remainder of this quarter, we will focus on further improving player engagement as we continue to acquire new users. And we are continuing to tune the game economics and the operation of its heroes. We expect to release additional nonsocial casino gaming apps like Undead World in 2022.

Our next such game is in the later stages of development and is currently planned to be released in open beta in Q1 of next year. We will also continue to make updates to our core DoubleDown Casino platform to enhance customer engagement and strengthen customer lifetime value.

Regarding our financial results, we are pleased with our third quarter performance, our first as a public company. While revenue decreased 6% from Q3 2020 due to the easing of stay-at-home initiatives during the height of COVID-related restrictions last year, adjusted EBITDA increased 4%. We were able to grow adjusted EBITDA despite lower revenue as we focus on optimizing returns from our sales and marketing spending, which our CFO, Joe Sigrist, will discuss in more detail momentarily.

Also, during this quarter, we generated $33.7 billion in net operating cash flows and ended the quarter with a cash balance of $223.1 million providing us with a strong financial position. Importantly, our business model should continue to be one that produces significant positive free cash flow each quarter.

Now I will turn it over to our CFO, Joe Sigrist, to walk you through our financials before providing my closing remarks. Joe?

대체로 소셜카지노 회사들이 기존 장르에서는 이미 성장의 한계를 맞이했고 타장르로 진출해 돈을 벌려고하는데

이게 참 쉽지가않다. 언데드월드도 이러한 노력의 일환인데 잘될지 모르겠고 신작게임도 마찬가지

Joseph Sigrist

Thank you, I.K., and good afternoon, everyone. As a reminder, DoubleDown Interactive completed its Initial Public Offering on September 2, 2021, issuing approximately 6.31 million American Depository Shares which we will refer to as ADSs on this call, each representing 0.05 of a common share at a price of $18 per ADS. Of this, the company sold 5.26 million ADSs and STIC, Special Situation Diamond Limited sold 1.05 million ADSs. DoubleDown received net proceeds from the offering of $86.5 million after deducting underwriting fees and commissions and certain offering expenses which we plan to use to fund our growth initiatives.

Our revenues for the third quarter of 2021 decreased 6% to $87.0 million from the prior year period. As I.K. mentioned, Q3 2020 benefited from the widespread stay-at-home COVID prevention initiatives in place at that time which have significantly abated since then. Despite the revenue decrease, we are encouraged with several key monetization metrics that improved from the comparable period last year.

Average revenue per daily active user, or ARPDAU, increased from $0.86 to $0.96. Payer conversion, which is the percentage of players who pay DoubleDown, increased from 5.4% to 5.7%. And average monthly revenue per payer increased from $196 to $224.

At a high level, we would characterize these trends in our KPIs as indicative of our disciplined focus on growing wallet share of paying players while allowing attrition of nonpaying players. Accordingly, we believe KPIs that are aligned with paying players are more useful in evaluating our progress rather than aggregate user metrics.

Total operating expenses for the third quarter of 2021 decreased 17% to $59.2 million from the prior year period. The decrease was primarily due to a combination of lower sales and marketing costs and lower depreciation and amortization expenses. Specifically, sales and marketing expenses declined 18% from the comparable period a year ago to $17.2 million as we continue to optimize our investments to acquire new players in light of Apple's new app tracking transparency framework and changes to IDFA, Apple's identifier for advertisers.

In addition, cost per install or CPI for mobile users trended higher during the summer, which caused us to be more cautious in advertising spend during this period. Overall, we feel confident about our ability to continue to measure and track the efficiency of our new player acquisitions. Optimizing the ROI of our sales and marketing expenses is at the core of our financial framework to diligently manage our P&L.

Depreciation and amortization expenses declined to $2.4 million in the quarter compared to $8.0 million in Q3 2020 at the useful live schedules from assets acquired as part of DoubleU Games 2017 purchase of DoubleDown Interactive LLC continued to end. Net income for the third quarter of 2021 totaled $22.8 million or $9.91 per diluted share, which was higher than the prior period of $8.3 million or $3.75 per diluted share.

Note that our common share count at the end of the third quarter was approximately 2.5 million shares. As a reminder, each of our American Depositary Shares that trade on NASDAQ represent 0.05 of a common share.

Adjusted EBITDA for the third quarter of 2021 increased 4% to $30.2 million from the prior year period. Adjusted EBITDA margin of 34.7% represents an approximate 330 basis point improvement from the prior year period. The improvement in adjusted EBITDA and adjusted EBITDA margin is primarily attributable to the lower sales and marketing costs I previously mentioned.

Adjusted EBITDA and adjusted EBITDA margin are non-GAAP measures, which we believe are useful in evaluating our operating performance. A full reconciliation of these measures to the most directly comparable GAAP measure is available in the earnings release.

Cash flow from operations for the third quarter of 2021 increased 49% to $33.7 million compared to the prior year period, primarily due to the timing of payments from our platform partners. We did not incur any material capital expenditures during the quarter.

Finally, turning to our balance sheet. At quarter end, we had $223.1 million of cash and cash equivalents. The improvement in our net cash position was due to the aforementioned net cash flows from operations and the proceeds from our Initial Public Offering.

That completes my financial summary. Now I will turn it back over to I.K. for closing remarks.

결제유저수는 줄어들지만 유저당결제액을 높히는 방향을 취하고있는듯

좋게말하면 방어고 나쁘게 말하면 성장의 하락같은 느낌

Question-and-Answer Session

Operator

[Operator Instructions]. Your first question comes from the line of David Bain of B. Riley.

David Bain

Great. I.K., Joe, very nice execution on the quarter. I guess my first question, could you offer any broad commentary surrounding the potential reduction of platform fees from Apple or others? I mean, is that something that you think could positively impact margins next year? Are there certain strategies you're testing internally or planning for at this point?

Joseph Sigrist

Yes, Dave, thanks so much for the question and your comment. I can start, and then I.K. can comment perhaps. Obviously, the entire gaming and mobile gaming industry is excited about the potential, and I'll stress potential, for the lowering of platform fees based on the court rulings. And we are interested to see not only how Apple reacts to it, but also, and I think more importantly, in the shorter term, to how other gaming companies might be changing their games to execute on how they would implement non-Apple ways of collecting payments. And I think that's going to be the key for us, which is to kind of decide how we implement, which I think is on one level pretty straightforward, these alternative payment processors. But in a way that we believe based on what others in the industry, frankly who are larger than us do, as far as what they think will be acceptable, frankly, to Apple.

In Keuk Kim

Yes. To support Joe's comment, from a development standpoint, we're already ready for taking those advantages. But it will depend on other gaming companies' implementation. From December, if we take a look at our other competitors or other mobile gaming companies in comparison, we will -- right now, we will be ready right now. So hope this helps.

애플의 앱결제 수수료 관련해서인데 회사측에서도 이걸 준비하고있다고 하는듯 ALREADY READY라니..

David Bain

Okay. Yes. No, absolutely. So my next question would be, and we get this question/topic a lot. So maybe you can -- take me some phone time. Wondering if you could give your broader view on M&A. First, as it relates to several social casino competitors acquired in your space, GSN, Bowl Game, Side Play. I mean, they all seem to obviously highlight your own valuation. But does that indicate any kind of competitive marketing shift under new ownership? Are you seeing or hearing anything?

And then as it relates to M&A also, we get this question, if you could discuss your own strategies. And I mean the $220 million plus of cash -- forward cash generation, is there a strong supply out there, acquisition valuations rational?

And then I know it's a multipart question, but if you don't find anything significant, would the Board consider return to capital opportunities over the longer term? So the third part was -- the first one was M&A as it relates to your own core space and then your own strategies.

Joseph Sigrist

Great. Thanks for the cliff notes on a long question there. Yes, no, no. I think let's start with M&A. And what -- first of all, what's out there. I think you asked perhaps to comment on some of the more recent activity. I mean, it's not a lot that we can say about what others have done, except maybe to say it's interesting how -- I don't know if I can say social casino is hot again, but it's interesting how there have been some -- you mentioned the GSN deal specifically and others that our social -- the acquisition of social casino companies or companies that are primarily social casino that have been bought for some pretty nice valuations, where I think over the last at least 2 or 3 years, there have been fewer of those types of transactions, at least in social casino.

Now I think there still is a great interest amongst social casino companies to purchase companies outside of social casino to expand. But I just will comment that what you said about social casino companies being purchased is kind of an interesting thing that's happened since the summer.

As far as what we're looking for, I mean, and we said this during the road show, we're looking potentially for companies to acquire -- that can really move the needle for us. And so companies that have -- revenue companies that have games in market with players. Obviously, those companies are -- there are fewer of those than perhaps studios that are just developing a game or just launched a game. And there are a number of folks out there who maybe have a game in beta or something that are looking for someone to help them fund the marketing. And there are a number of those out there as well.

But I think for us, and this may mean it takes us a little longer than perhaps if we had been -- if we look at other of those companies. We are looking for companies that can really help us move the needle.

And then the question about what happens if we don't. Other uses of cash, I think. Certainly, we -- shareholder value and maximization of shareholder value is the most important objective for us. And as a result, given our cash balance, we definitely need to look at all ways and all methods to maximize shareholder value. And so we won't take anything off the table.

M&A에 대한 언급이 나왔는데 결국엔 소셜카지노 이외의 회사들을 찾고있고 move the needle.

회사에 가시적인 변화를 가져올만한 회사를 찾고있다고한다.

David Bain

Congratulations again.

In Keuk Kim

Yes, sorry. Just first you had comment lately to M&A opportunity. We also look at additional opportunities related to NFT, non-fungible token opportunity and but actually, it will fit a lot to our gaming content. So we look forward to taking those advantages for M&A. I hope this helped.

NFT 발언까지함ㅋㅋㅋ

Operator

[Operator Instructions]. Your next question is from Greg Gibas of Northland Securities.

Gregory Gibas

Congrats on the nice EBITDA improvement. I wanted to ask, I guess, on kind of new developments, how the rollout of Undead World is maybe going so far relative to your expectations initially? Kind of how you're marketing it differently relative to DoubleDown Casino? And then just wanted to kind of gauge you on timing and kind of general cadence of new launches and kind of how development is going for the space-related game, Spinning In Space, I believe it's called.

Joseph Sigrist

Yes. I'll just quickly describe how we believe the game is going in the market. And then I'm going to ask I.K. to talk about the marketing of the game, which I think is interesting. Relative to results, I mean it is early days. We just launched about 5 weeks ago, global launch. And consistent with what we saw during the open beta period, we're really pleased with player retention which means repeat play once we acquire a user. And ultimately, that's the first step in getting players to convert and then ultimately to continue to monetize over time and maximize LTV.

So right now, we're continuing, as I believe I.K. said in his comments, to not only acquire players, but also to continue to enhance the game, tweak the game from a monetization standpoint, so we can continue to drive up monetization which is important. But I think for us, it's very encouraging to see player retention at this early stage in the release of the game.

언데드월드는 일단 플레이어를 모으고 수익화하기위해 노력한다고한다

In Keuk Kim

Yes, related to marketing difference of Undead World. Fundamentally, performance marketing uses similar targeting [indiscernible]. However, each channel's inventory is totally different, and it will take time to get meaningful volume based on different genres. To that end, test larger volume, we are testing influencer marketing for Undead World. It is one of the different inventory compared to social casino app.

And related to user player retention, actually, we now see above 20 to 25 for the user retention, which is a huge number compared to other competitors. So we will focus on how to utilize those retention to net highs going forward. Hope this helped.

경쟁사보다 리텐션 잘된다고는한다.

Joseph Sigrist

Yes. I think, Greg, you also asked about the final part of that. The next game, the next game in the expand beyond social casino category, that we have. And that's the space game that I think you referenced, which we had said in our comments here that we're planning open beta to be in the first quarter of 2022.

내년 1분기에 우주관련된 카지노게임을 낸다는듯 소셜카지노 범주라고 하기엔 확장된(?) 게임이라고한다.

Gregory Gibas

Okay. Great. Yes. Nice to hear that it's on track. And yes, I think you previously said first half of next year. So good to hear, and I appreciate the additional color there. I'm just wondering, too, as we kind of think about the fourth quarter, how kind of seasonality impacts the business? And how you're thinking about kind of the holiday season and maybe year-over-year impacts because I know you said kind of Q3 was impacted by more stay-at-home a year ago. So how you're thinking about that?

Joseph Sigrist

Yes. I mean there's several or a couple, I guess, important seasonal factors in the fourth quarter. Certainly, one is the fact that there are more people at home -- separate from COVID, of course, there are more people home during the holidays. And generally, the holiday period is good for mobile gaming. And we've seen that, especially compared to, again, the seasonality that we've seen in past years in the third quarter, which includes the summer which has kind of people not at home. And as a result, not playing as much. Again, this is all ex-COVID. So I think that's one positive factor.

The other seasonal factor in the fourth quarter is CPIs, which tend to go up. And so I had mentioned that CPIs in the -- especially the latter part of the third quarter, we had seen increase. Now in October, we -- late September, October, we had actually seen -- had seen CPIs, both for Android and for iOS users decrease somewhat, which was good. But we certainly anticipate essentially starting now, if history is any guide, that as we get into the holidays, that CPIs will increase. And so that's something we have to be mindful of as we are always acquiring new players. But we certainly don't want to overspend. And as you know, ROI of acquired users is our most important -- one of our most important metrics that we follow.

4분기는 3분기보다 사람들이 집에 많이 있을 것이기때문에 실적이 3분기보다는 괜찮을 것

Gregory Gibas

Okay. Great. I was going to ask on M&A, but I think you covered that pretty well. I guess the last one for me, just relating to kind of OpEx trends going forward. I know you said you pulled back your spend a little bit, just seeing the trends on player acquisition costs. Any thoughts on that, I guess, going forward?

Joseph Sigrist

Yes. I mean I think just actually following on to what I said a minute ago, I mean, we do have the seasonal increase second half of the quarter that we have to be mindful of in CPIs that would cause us maybe to pull back a bit. At the same time, we -- we'll have this quarter the first kind of -- and it's a full quarter impact of the launch of Undead World. And so we definitely will see investments in that area as we want to make sure we launch the game strongly. And so I would expect that would mean that overall, we would be spending more this quarter.

Operator

[Operator Instructions]. At this time, this concludes our question-and-answer session. I would now like to turn the call back to Mr. Sigrist.

Joseph Sigrist

Great, Bo In Hye. Thanks again. Thank you, guys, all for joining us on our call today and for your interest in DoubleDown. We look forward to sharing future updates with you as we continue to innovate and grow the business and take advantage of a truly exciting global digital gaming industry. Thanks again. Have a great rest of your day.

기존 앱은 약간 소셜카지노 '플랫폼' 역할을 수행하려고

올인원앱 전략을 구사

소셜카지노 앱에 여러가지 게임들을 집어넣는거임

어차피 접속하던 사람들은 슬롯땡기다가 포카도 치고 빙고도 맞추고

앱안을 라스베가스로 만들겠다는거지

위와같은 효과를 기대해볼 수 있다.

data driven capabilities라고는 하는데

이게 소셜카지노 회사들의 진입장벽같으면서도

내 생각엔 1/2/3 이정도만 플레이어가 남아야하지않을까도싶다.

소셜카지노 회사들이 대체로 다른장르로 진출하고있는 가운데

더블유게임즈도 마찬가지로 그런 기회를 엿보고있는 것 같다.

작금의 상황이 이러한 방향으로 흘러가는 가운데

1. 올라가는 게임개발 인건비

2. 올라가는 게임회사의 몸값

이 두가지가 참... 어려운 것 같다.

내 생각엔 지분을 사오는게 베스트일 것 같은데

김가람대표 그런 알짜회사에 베팅할 수 있을까

DDI처럼 화끈한 베팅을 원하는데.. 요새 뭘하고계신걸까

궁금하다...쩝

'주식 > 더블유게임즈' 카테고리의 다른 글

더블유게임즈 IR 문의내용 및 소송 (0) 2021.12.11 [더블유게임즈]플레이티카(PLTK) 21년 3분기 컨퍼런스콜 (0) 2021.12.07 더블유게임즈 21년 3분기 실적발표 및 컨퍼런스콜 (0) 2021.11.11 더블유게임즈 미친 등락폭의 하루 (0) 2021.10.22 더블유게임즈 회사채 발행 모집 대실패와 스코플리 인수 (0) 2021.10.21