-

버크셔해서웨이(NYSE: BRK.B) 3분기 자사주매입과 실적주식/버크셔해서웨이 2020. 11. 9. 07:54

https://news.naver.com/main/read.nhn?mode=LSD&mid=sec&sid1=104&oid=001&aid=0011999104

'투자의 귀재' 버핏, 10조원 자사주 매입…역대 최대

(뉴욕=연합뉴스) 강건택 특파원 = '투자의 귀재' 워런 버핏이 이끄는 버크셔해서웨이가 역대 최대 규모의 자사주 매입을 단행했다. CNBC방송에 따르면 버크셔해서웨이는 7일(현지시간) 공개된 3분

news.naver.com

버크셔해서웨이의 3분기 실적발표가있었다.

이번분기 버핏은 한화로 10조원 규모의 자사주매입을 했다고 한다.

Average price는 잘 모르겠다

진짜 싸게 샀으면 190 언더겠거니..

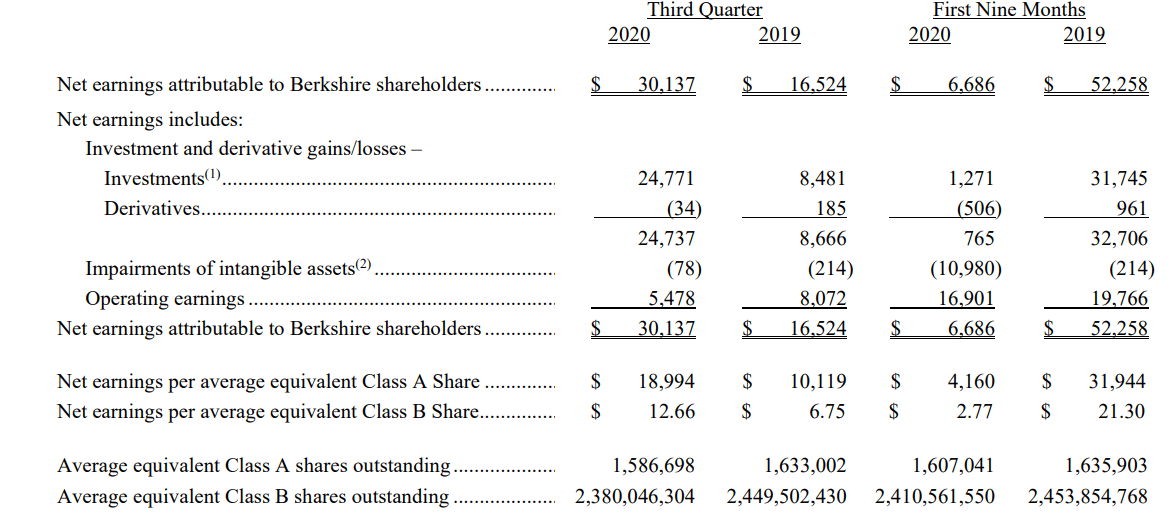

Net earnings는 굉장히 훌륭하지만

operating earnings는 좀 안좋았다. 아마 철도와 보험쪽, 버크셔 자회사쪽이 안좋았지않을까싶다.

결과적으로 first-nine month 기준으로 op earnings같은경우 19.8B --> 16.9B 으로 15%가량 줄었다.

저기 마이너스 구멍이 큰건 주석에 써있듯이

Impairments of intangible assets in the first nine months of 2020 include charges of $9.8 billion recorded in the second quarter attributable to impairments of goodwill and certain identifiable intangible assets that were recorded in connection with Berkshire’s acquisition of Precision Castparts Corp. in 2016.

버크셔 자회사 중 프리시전 캐스트파츠의 상각때문인듯

https://post.naver.com/viewer/postView.nhn?volumeNo=28899929&memberNo=38678858&vType=VERTICAL

버크셔 해서웨이의 경쟁우위 원천: 강력한 자회사들

[BY 아이투자] [편집자주: 아래 글은 아이투자 특약 밸류워크(valuewalk.com)의 7월 13일자 글입니다.] *...

m.post.naver.com

버크셔의 짱짱한 자회사들(이라쓰고 돈을 때려부어야 살 수 있는 크기의 기업들)

그리고 주식 수가 계속 줄고있다. buyback 했기 때문

버크셔의 자사주매입이 눈길을 끄는건 버핏의 자사주매입은 단순히 주주환원을 위한 것이 아니라

버크셔가 상대적으로 싸기때문이다.

https://seekingalpha.com/news/3633328-berkshire-hathaway-buys-back-9b-in-stock-in-q3

Berkshire Hathaway buys back $9B in stock in Q3 (NYSE:BRK.B)

Berkshire Hathaway (NYSE:BRK.B) (NYSE:BRK.A) bought back ~$9B of stock during Q3, bringing the nine-month total to ~$16B.That's up from the $5.1B of stock the conglomerate bought in Q2.Q3 operating earnings of $5.48B vs.

seekingalpha.com

Berkshire Hathaway (NYSE:BRK.B) (NYSE:BRK.A) bought back ~$9B of stock during Q3,

bringing the nine-month total to ~$16B.

That's up from the $5.1B of stock the conglomerate bought in Q2.

Q3 operating earnings of $5.48B vs. $5.51B in Q2 and $8.07B in the year-ago quarter.

The only major business segment to see a Y/Y increase in operating earnings was railroad, utilities and energy, while insurance underwriting posted a loss vs. a year-ago profit. (updated at 8:18 AM).

Losses and costs associated with COVID-19 negatively hurt its commercial insurance and reinsurance underwriting results; furthermore, future judicial rulings and regulatory and legislative actions relating to insurance coverage and claims may affect future results.

"Our underwriting results for the remainder of 2020 and the first quarter of 2021 for certain business may be adversely affected from lower premiums attributable to credits granted to policyholders and where premiums are a function of the insured’s payroll," the company said in its 10-Q.

Operating earnings by segment:

Insurance underwriting: loss of $213M vs. earnings of $440M a year ago.

Insurance - investment income: $1.02B vs. $1.48B a year ago.

Railroad, utilities and energy: $2.74B vs. $2.64B a year ago.

Other businesses: $2.35B vs. $2.46B a year ago;

Other: loss of $412M vs. earnings of $1.05B a year ago.

Q3 net earnings of $30.1B vs. $26.3B in Q2 and $16.5B a year ago; investment gains fell to $24.8B vs. $31.0B in Q2 and rose from $8.7B a year ago.

Insurance float was ~$135B at Sept. 30, 2020, vs. ~$131B at June 30, 2020.

Update at 8:12 AM ET: The company had ~$145.7B of cash, equivalents and short-term investments as of Sept. 30, 2020, just under the $146.6B it had at June 30.

8:28 AM: About 70% of Berkshire's investments in equities securities' aggregate fair value at Sept. 30 was concentrated in four companies with Apple (NASDAQ:AAPL) by far the biggest, at $111.7B. The others are Bank of America (NYSE:BAC) at $24.9B, Coca-Cola (NYSE:KO) at $19.7B, and American Express (NYSE:AXP) at $15.2B.

At Dec. 31, 2019, its investments in those four companies represented 60% of aggregate fair value — $73.7B for AAPL, $33.4B for BAC, $22.1B for KO and $18.9B for AXP.

Digging further down into Berkshire's 10-Q filing and the company's unit results, its railroad, BNSF saw earnings before income taxes slip to $1.78B vs. $1.94B in Q3 2019, primarily due to lower volumes because of the pandemic.

Berkshire Hathaway Energy's earnings before income taxes increased to $1.12B from $1.06B a year earlier.

Manufacturing earnings before income taxes fell to $2.26B from $2.48B, and service and retailing earnings before income tax increased to $779M from $639M.

McLane Company saw earnings before income taxes nearly double Y/Y to $96M from $50M.

그리고 댓글중에 long 의견 댓글

My read on this release:$9 billion in share repurchases! Repurchased in August at an average price of $210 and September at an average price of $216. Hopefully he is stepping on the accelerator right now! This level of repurchases will start moving the needle, and has been a huge winner for Apple - glad to see Berkshire starting to get serious with this.Still a ton of cash.

Current market cap after the buybacks of $498B, Shareholder's equity of 415B, current Price/Book of 1.2xOperating earnings of $5.5 billion (my estimate was $5.75B) vs. prior year of around $8B.Insurance swung to a small loss as I expected and was telegraphed. GEICO had an underwriting profit of $3B in Q1+Q2, down to $276m in this quarter.

BH Reinsurance group has lost $2B this year, versus $305m in 2019, lost $1.1B in 2018 and $3.6B in 2017. Much of this poor performance has been in retroactive reinsurance, but the good news is that Berkshire hasn't written any new contracts for it in 2019 or 2020.

Investment income down significantly ($500m) mostly due to declines in interest rates in t-bills. Even more reason to repurchase shares in Berkshire. Some due to selling shares in banks mostly likely as well.BSNF has held up incredibly well. Pre-tax earnings from last year (and this quarter last year) down less than 10%.

BHE up 20% in the quarter from last year. Manufacturing businesses rebounded more than I expected: pre-tax earnings are almost flat year over year (2% increase in tax rate is the main difference between the periods.)"Other" was weak. Equity method earnings were down $250 million. But the majority of the year over year decline, $720 million, was due to exchange rates. I think this is a VERY strong report.

가끔보면 터무니없이 long 외치는 사람들이 많긴한데

적절한 논리로 long외치면 눈에 확띈다.

역시 논리가 강해야..

아 버핏형!

'주식 > 버크셔해서웨이' 카테고리의 다른 글

버크셔해서웨이(BRK.B) 21년 2분기 밑줄쫙 (0) 2021.08.21 버크셔 해서웨이(BRK:B) 21년 1분기 밑줄쫙 (0) 2021.05.04 Berkshire hathaway(BRK.B) 현금을 만드는 기계 (0) 2020.06.27 버크셔해서웨이(BRK.B) 버크셔는 S&P 500보다 못한가? (0) 2020.05.20 2020년 1분기 버크셔 해서웨이 주주총회 요약 (워렌버핏의 전망) (0) 2020.05.03